Right off the bat, I noticed that Moneydance isn’t nearly as pretty as iBank. Fortunately, it was easy to re-assign the errant transactions from one account to the other such that I could ultimately delete the duplicate. The only other glitches were that I wound up with an extra bank account called “Unknown: PAYEE” (I ended up deleting this with no problems) and one of our investment accounts, somehow got split into two identically named accounts. Yes, it took a couple of hours before I was completely up and running, but I was dealing with 14+ years of data. All in all, it was pretty straightforward. This not only fixed underages in our bank accounts, it also fixed the overages in our investment accounts. Once I figured this out, however, it was an easy thing to cruise through out accounts and delete the duplicates. This latter bit – the transfer out – got included in the split deposit, but then got duplicated on its own. I’m talking here mainly of payroll deposits that included numerous deductions as well as a transfer out to a retirement account. The most obvious problem was that certain types of split deposits got screwed up. Some of the balances were off by a bit, but it was close enough that I figured I could sort it out. I thus decided to start from scratch, but skip the “Import Account Info Only” step. I ended up with bizarre (and hugely negative) balance in our bank accounts, etc. The accounts got set up properly, but when I imported my transaction data, it was a mess. The trouble with this approach is that it didn’t work very well for me. Once you’ve verified the accounts, uncheck that box and repeat the process to import your data. When it comes up, choose “Import File.” Next, be sure that the “From Another Program” button is selected – if you don’t, your categories will get screwed up.įrom there, the official guidance from the Moneydance creators is to check the “Import Account Info Only” box and run the import to create the account so you can verify that they’re right.

#Quicken vs moneydance install#

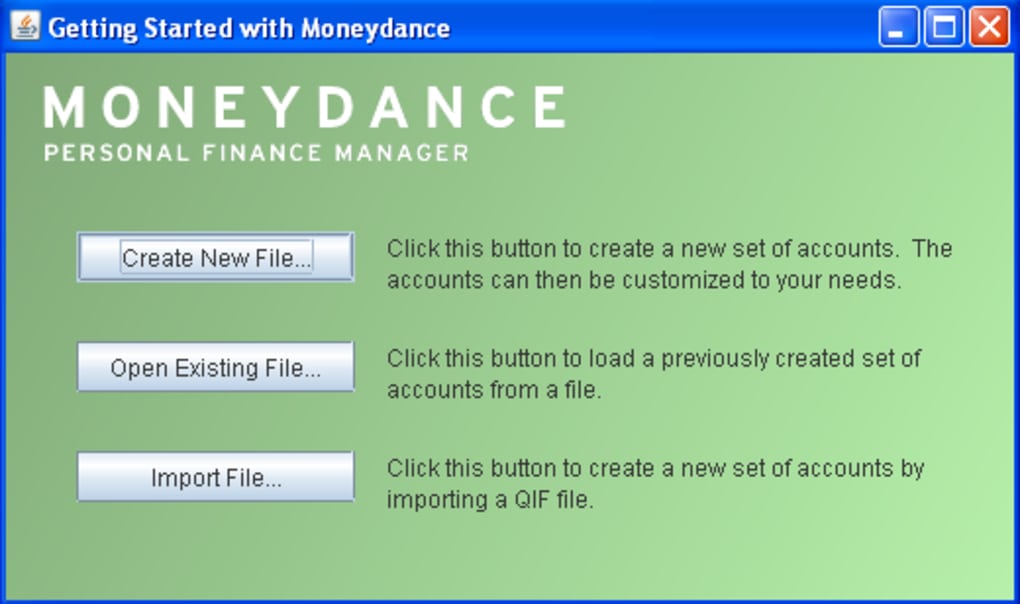

The next step is to install and launch Moneydance. If you need details on exporting to QIF, check out my previous post. In fact, I used the exact same QIF export file for Moneydance that I used for iBank. The process here is identical to what I went through for iBank. Thus, I took the plunge… Getting your data out of Quicken However, I had read enough reviews that I was convinced that Moneydance was the next best option on my list. A limit of 100 transactions really isn’t enough to thoroughly test out the software, and I thought twice about even giving it a shot. Given that Moneydance costs $50 (though you can easily get a $10 discount more below) I wasn’t too crazy about this highly restrictive trial.

#Quicken vs moneydance trial#

Unlike iBank, which has a 30 day free trial, Moneydance has a free trial that is limited to 100 manually-entered transactions. So… I next turned my attention to Moneydance from The Infinite Kind and crossed my fingers that I wouldn’t need to go further down my list of Quicken alternatives. I’m a bit of a power user when it comes to tracking investments, and the reporting features (and lack of a true portfolio view) were deal killers for me.

In short, iBank is a solid option, but it’s not right for me. However, if you still have a previous version of Quicken that can export your data in QIF format, you can find instructions for this here.On Monday I talked about my experiences moving from Quicken to iBank. It's hard not to see this as another attempt to lock customers into their software. To be clear, this is entirely a result of the decision Quicken made to drop the remaining file format that other programs can read. We will continue working on this issue, but cannot speculate on when, or if, we will be able to access this new file format. In short, this means that there is no longer a way for users of some of the latest versions of Quicken to move their data to other programs like Moneydance.

We've tried to access this file format, but have so far had little success. It appears that this format is intended for moving data between different versions of Quicken. Quicken now seems to offer a QXF export format. The program still seems to offer exports in the CSV format, but that format is not able to handle data as complex as an entire financial history, to successfully move it to another program. Moneydance cannot read the native Quicken file format, as this is a propitiatory file format owned and maintained by Intuit.

#Quicken vs moneydance software#

In general, this has been the only format they have provided that is readable by other personal finance software like Moneydance. Unfortunately, it appears that some versions of Quicken might have removed the ability to export data in the QIF format.

0 kommentar(er)

0 kommentar(er)